“Should I buy gold?” or “I heard that now is a good time to buy gold…” is typically how the conversation starts. We are frequently asked by clients about gold and if there is a place for it in their investment allocation. While there is definitely a place for gold the most important question we ask is “why do you want to own gold?” In our opinion there are two primary reasons. Let’s take a closer look at each.

Reason One: An Economic Collapse

The argument usually starts with, if everything goes to hell in a hand basket then at least gold will be worth something. We couldn’t agree more. If you’re truly looking for protection in a major economic collapse then we absolutely support anyone looking to buy gold, but don’t buy gold investments, buy the actual raw material. You can buy gold bars, mini bars, coins, jewelry, there are a lot of different options. We would steer clients towards coins because they are small, easy to store and easy to actually use if needed. Most of all they are easy to purchase. It is very unlikely this will ever be the case and most people actually don’t think along these lines, but if you want to be prepared, go for it. The reality is if you do by a bag of gold coins, lock them in your safe and forget about them for the next 20 years it will probably work out to be a fine investment. Just don’t buy them for that reason.

Reason Two: An Investment That’s Not a Stock/Diversification

This is the primary reason we get asked about buying gold. Clients want to have something that’s tied to a commodity and not corporate earnings and shareholder equity. We often find two things with this strategy: One, most people buy a gold ETF that is full of gold companies, thus defeating the purpose. Two, you may not be getting the diversification, or reduction in risk, you’re thinking. Here’s why.

When you buy a gold mutual fund or ETF (Exchange Traded Fund) it is typically full of companies that mine gold, are part of the manufacturing process, etc. While these companies will typically trade higher and lower as the price of gold rises and falls, they are subject to the same scrutiny of every other publically traded company. If gold rises by 5% in a quarter, but the company looses 12% due to mining operations, much, if not all, of their gains could be wiped out. Again, you are not getting the diversification you are looking for. You end up buying more stocks that happens to be in the gold business.

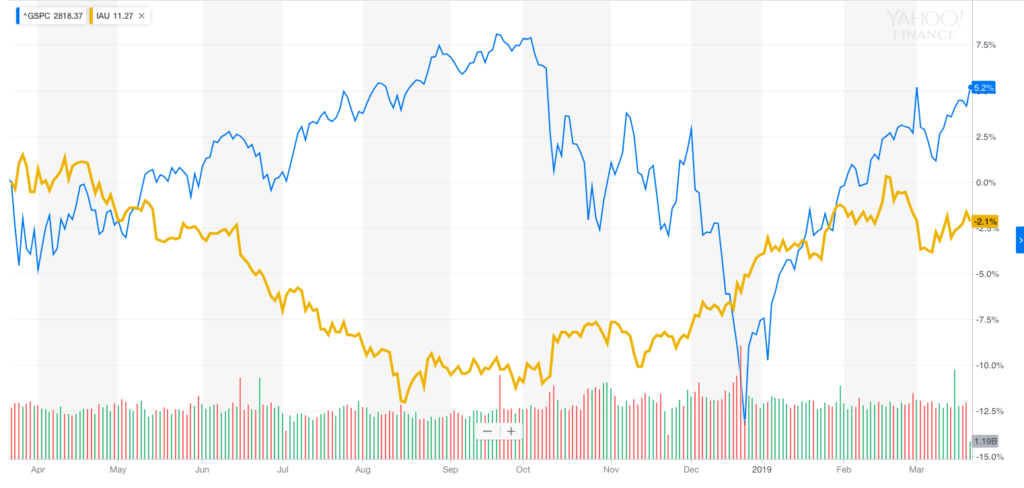

The second thing to consider is are you truly getting the diversification and reduction in risk you really think you are? There are ETF’s that are solely based on the price of gold. IAU, iShares Gold Trust, is one example. But, look at the charts below. The first chart compares the S&P 500 to IUA over the last 12 months. The blue line is the S&P 500 and the Gold line is well, Gold. As you can see total returns over the period are not that much different (5% vs. a 2% respectively), but what typically surprises clients is the volatility of gold. During the run up of early last year and the subsequent fall in the fall of 2018, the two largely moved in opposite directions, which is what you would hope for in a diversification strategy., but their volatility was almost equal.

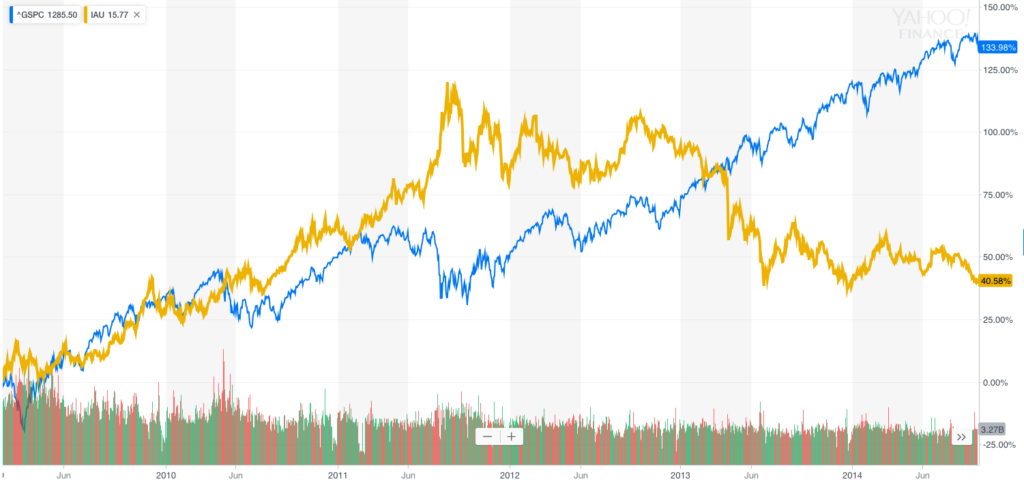

Now consider the second chart. This shows again the S&P 500 over the last 10 years. Two things to point out: First, largely until 2011 gold and the market moved in very close proximity, the gold line and the blue line almost overlap. Not much diversification. After that point look at how the gold line moves. Pay less attention to its overall direction, but more to the size of the peaks and valleys. They are frequently two and three times that of the S&P. Second, it is worth noting the difference in return over the last 10 years, 133% vs. 44% cumulative return over the period.

This could flip flop the next decade, which brings us back to our original question of “why do you want to buy gold?” The advice we give clients is if it is for the “just in case scenario”, go for it, but buy the coins. If it is for diversification purposes or chasing return, we hope you now know that it might not be all that you’ve heard.

Hopefully that’s some advice that’s worth its weight in gold…

The Cascade Team